Insights At-a-Glance

- Institutional capital is re-engaging in commercial real estate (CRE); pricing is normalizing as bid-ask spreads narrow.

- Alternative lending, private credit, and banks via debt funds are key financing channels into 2026 multifamily and commercial real estate

- Living sector (multifamily, student, senior, SFR/BTR, manufactured) remains structurally undersupplied after record 2024–2025 deliveries.

Multifamily & the Living Sector: Demand Now, Shortage Ahead

Institutional capital is returning, but patience is still required as the market “bumps along the bottom” toward a healthy new normal. Opportunities are emerging for best-in-class operators as pricing realism and narrowing bid-ask spreads create attractive entry points, especially across the living sector. Despite record deliveries in 2024–2025, construction is declining, with a shortage likely in 2026–2027 and beyond.

Capital, Rates & Where Funding Comes From

Investors are recalibrating amid macro signals: since 2022, listed securities are up ~75% while CRE returns are down ~25%, and attention remains “incredibly” focused on the 10-year. Capital is flowing from retirement plans, pensions, wealth accounts, sovereign wealth and state funds, private credit funds and ABL, and traditional banks; the latter increasingly routing through private credit and debt funds to lower cost of capital. This mix underpins transaction activity driven by capitulation and conviction, the two themes driving the current CRE financing and transaction environment.

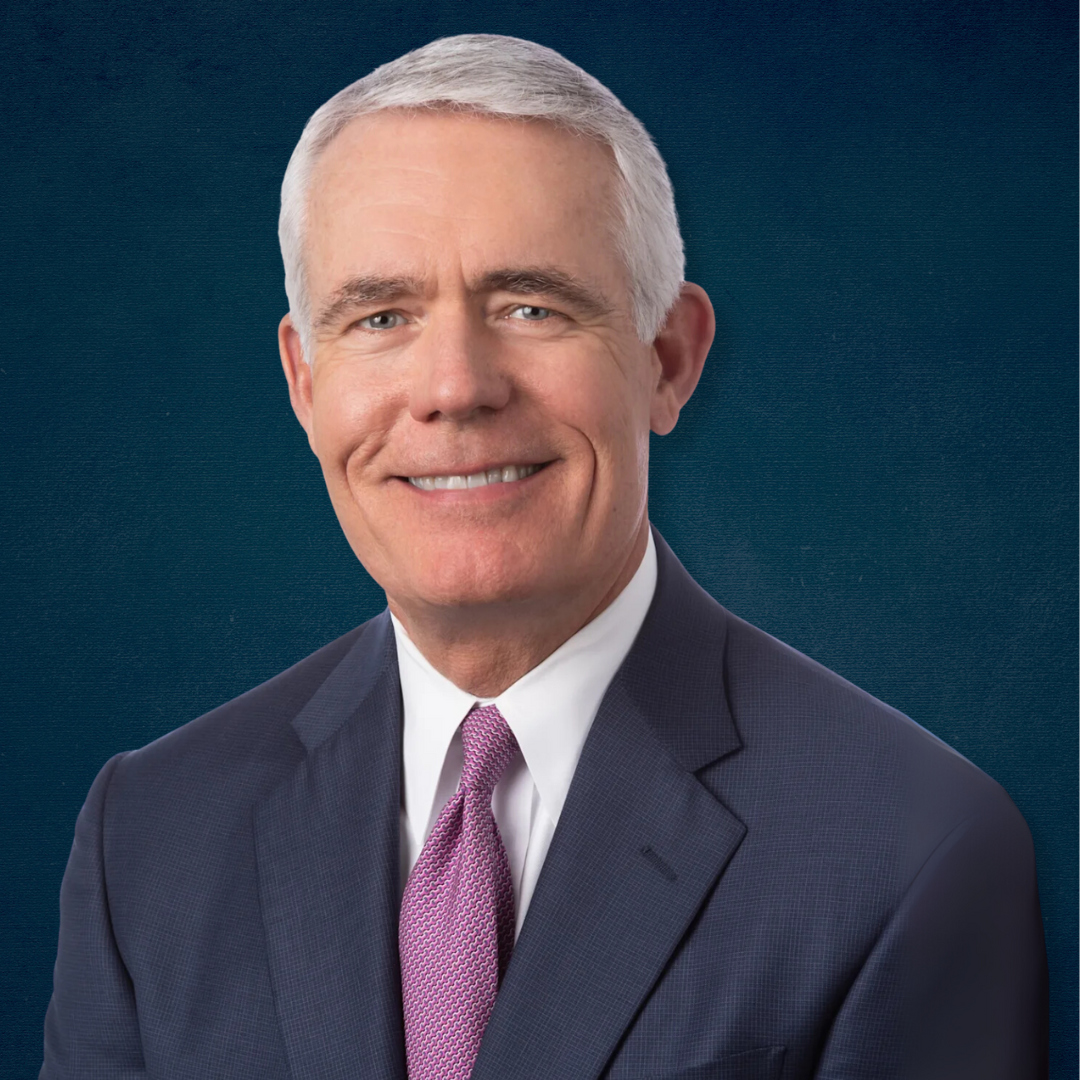

Strategy & Footprint

Allocations favor value-add and opportunistic plays; ODCE data shows a focus on living and industrial (with regional variability for industrial). EMBREY’s operating footprint spans Arizona, Colorado, Florida, Georgia, North Carolina, Tennessee, and Texas, aligning the platform with markets benefiting from durable housing demand.